Tax brackets are complicated system that adjusts for inflation. As a married taxpayer, your bracket may be lower than your spouse’s. Luckily, there are ways to figure out your tax bracket and maximize your refund. Read on to learn more about tax brackets and how married filers can benefit from them.

Tax brackets are a graduated tax system

tax brackets married filing jointly are a way to determine how much you should pay for your tax obligations. In the United States, tax brackets are used to determine the percentage of taxable income that is taxed at different rates. As a result, higher income levels pay more in taxes.

The tax rate that applies to income in a certain bracket is called the marginal rate. As a taxpayer’s income increases, their tax rate also increases. Those at the bottom of the income scale are taxed at a lower rate than those at the top. However, individuals who earn a higher income may lose tax benefits. For example, tax credits for higher education may phase out as a person’s income rises.

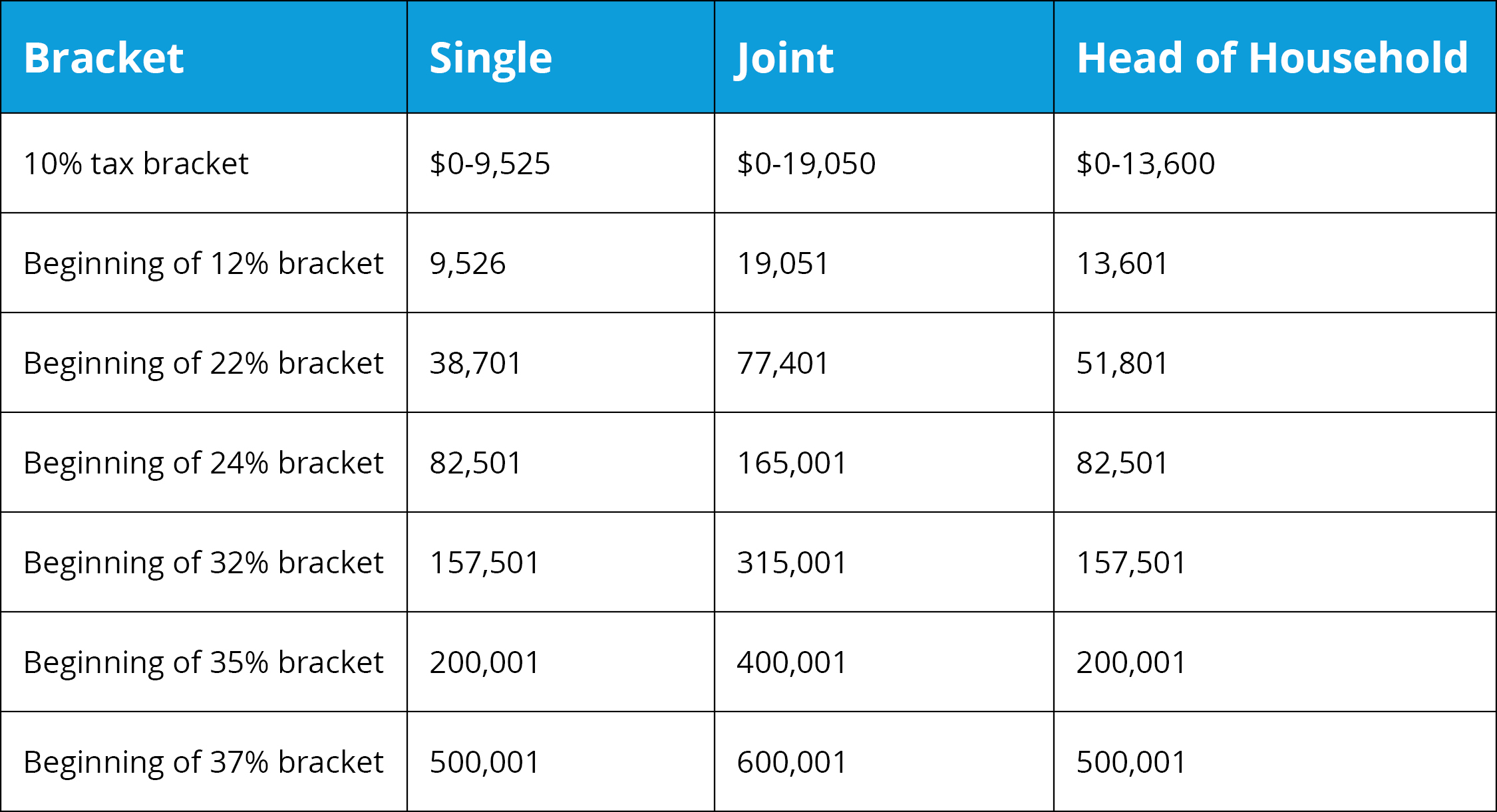

As of 2021, the federal income tax has seven different tax brackets for most people. These brackets are based on taxable income and the filing status of the taxpayer. This includes married filing jointly, single, head of household, and qualifying widow/widow. Most people have until April 18 to file their returns. However, if they have extra time, they can file for a six-month extension until Oct. 17.

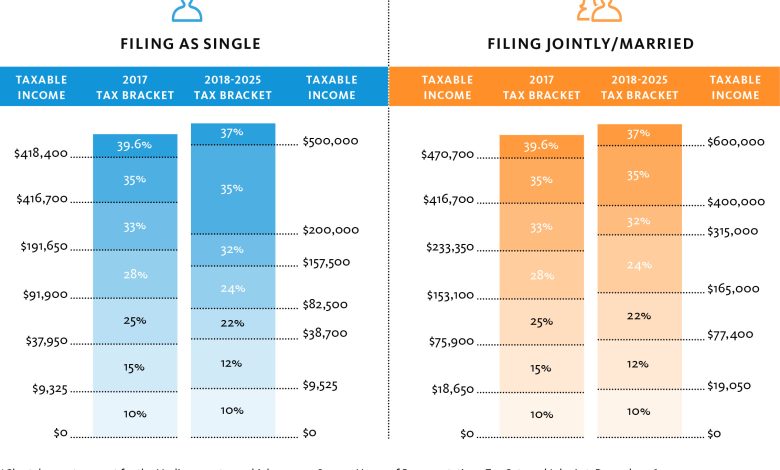

The IRS adjusts the tax brackets for inflation. For example, a single individual who earns $40,000 a year would fall into the 12 percent bracket. Similarly, a married filing joint would fall into the 22 percent bracket. In this scenario, the taxable income of a couple would be lowered by $1,800 if both spouses earned the same amount in 2021.

For married taxpayers, tax brackets are usually double-sized compared to singles. However, one exception to this rule is the penultimate bracket. This means that married taxpayers in that bracket may pay more tax by filing a joint return, but many couples do get a marriage bonus by filing jointly.

They are complicated

There are many advantages to filing jointly, but the tax brackets are complicated. If you file jointly with your spouse, you will be able to benefit from certain tax breaks. However, married filers filing separately aren’t eligible for these tax breaks. That means that if you file separate returns, you are responsible for the accuracy of your own returns and the taxes you owe.

You may wonder if it’s really worth filing jointly with your spouse if you earn more than a certain amount. The answer is: it depends. Your filing status determines your tax bracket and your tax liability. If you’re single, you don’t qualify for filing separately, but if you’re married, you’ll have to claim your spouse as your dependent on your return. Married couples who live together can file either jointly or separately. You also have the option of being a head of household if you earn more than half of the household’s income.

Income tax brackets are based on your taxable income. In general, if you earn more than $50,000, you’ll be parked in the highest tax bracket. That means that the first $9,075 of your taxable income is taxed at 10% and the next $27,824 at 15%. Then, the rest of your income is taxed at 25%.

Married couples filing jointly enjoy a “marriage bonus.” This means that they’ll pay less tax than if they were to file individually. However, it’s important to understand that the maximum amount of combined income for married couples is double that of single filers.

They are adjusted for inflation

The IRS has announced that the Tax Brackets for Married Filing jointly are being adjusted for inflation. This change amounts to a 7% increase in each bracket. The first $11,000 of after-tax income is taxed at a rate of 10%, while the first $22,000 is taxed at a rate of 20%. This adjustment has two related purposes: first, it reflects the rising cost of living, and second, it helps prevent “bracket creep,” or the loss of spending power by rising costs.

The income levels for the tax brackets have increased, and the standard deduction has increased as well. This is great news for taxpayers, as higher income levels mean lower tax rates. However, the changes in tax brackets aren’t the only changes that are happening. The tax rates are being adjusted annually to account for inflation, which will mean a higher standard deduction for most taxpayers.

The Internal Revenue Service (IRS) announced that the tax brackets for married couples and single individuals will be adjusted for inflation for the tax year 2023. The adjustment will also increase the standard deduction for married couples and single individuals. This change generally applies to the 2024 tax year, so it is important to know what the changes are and how they will affect your taxes.

As a result, the average income for married couples filing jointly will increase by 7%. The earned income tax credit is meant to help families in need, and increases as a taxpayer’s income increases. The maximum amount of this credit for married filers with three children will be $7,430 in 2023.

They benefit married taxpayers

There are many advantages to filing your taxes jointly, including lower tax rates and increased standard deductions. For example, a married couple filing a joint return will be entitled to a $24,800 deduction compared to a single taxpayer filing separately. A marriage bonus equaling 7.3 percent of the combined couple’s adjusted gross income is another significant benefit to filing jointly.

Married filers are also eligible for several tax credits. This includes the Earned Income Tax Credit, the Child and Dependent Care Tax Credit, and the American Opportunity Tax Credit. They are also eligible to claim a deduction for adoption expenses. These deductions make it easier for married couples to save on taxes.

However, filing jointly isn’t always advantageous. There are still many tax penalties that apply to married couples. These are usually imposed on higher-income couples who make more than $75,000 per year. However, the 2017 Tax Cuts and Jobs Act has reduced the effects of these penalties. The tax brackets for married taxpayers are almost double the single-income tax brackets. Additionally, the deductions for mortgage interest are capped at $750,000 for married taxpayers.

Some couples choose to file separately if their spouse has been absent from the workplace for six months or more. This may be for medical care, school, or military service. But filing jointly may be a more practical financial choice for married taxpayers. As long as you do your calculations correctly, filing jointly will benefit you and your spouse.

As you can see, there are several benefits to filing jointly. It can save you money. In addition to lower tax rates, filing jointly with your spouse can help you get higher deductions and credits. Depending on your income level, this could significantly reduce your tax burden.

They are used to avoid “bracket creep”

Bracket creep is an issue when inflation pushes taxpayers into higher tax brackets without legislation. This can result in a large loss of income for lower-income taxpayers, to reduce this loss visit filemytaxesonline.org. Luckily, there are ways to limit bracket creep and keep your net income stable.

One way to avoid bracket creep is to take advantage of the higher standard deduction. The standard deduction will increase by $900 for single filers and $1,800 for joint filers by 2023. The higher standard deduction will reduce your taxable income and allow you to stay in the lower tax bracket for longer.

Tax brackets are adjusted to reflect the cost of living. For example, a single filer with $90,000 in taxable income will pay a tax rate of 24 percent. In contrast, those earning less than $90,000 will pay a lower rate – 10 percent.

Using the tax tables will help you determine your taxable income and tax liability. The tables provide the tax bracket, rate, and amount of tax owed. The tables also include the amount of income you’re allowed to deduct. In addition, the tables are updated to reflect inflation.