Cathode Material for Automotive Lithium-Ion Battery Market Growth and Demand

Cathode Material for Automotive Lithium-Ion Battery Market Overview

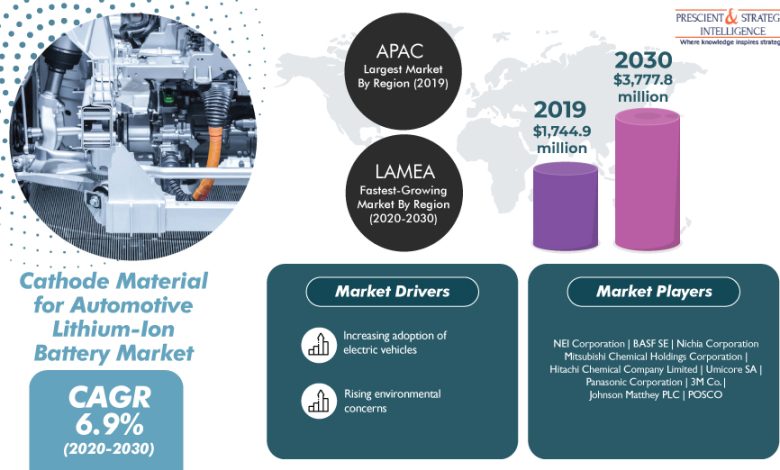

In 2019, 2.1 million electric vehicle (EV) sales were registered worldwide, and by 2030. The number of EVs in operation will reach 130 million. The demand for these automobiles is increasing on account of the surging environmental concerns and strong government support. As a result, the global cathode material for automotive lithium-ion battery market will grow from $1,744.9 million in 2019 to $3,777.8 million by 2030, at a 6.9% CAGR during 2020–2030.

Since all EVs have a battery, the demand for the latter is surging owing to the adoption of the former. This is helping the cathode material for automotive lithium-ion battery market advance. As with the increasing requirement for batteries. The consumption of materials that make up its various chemical components. Such as the cathode, anode, and electrolyte, is rising as well. The voltage and capacity of a lithium-ion battery are determined by the cathode, which is why cathode materials remain in high demand.

Size

During the COVID-19 pandemic, the cathode material for automotive lithium-ion battery market has witnessed a downfall, majorly due to the slump in the sales of automobiles. In addition, all non-essential manufacturing, commercial, and logistical activities had been suspended during the first half of 2020, which led to a lower supply of cathode materials and manufacturing of the batteries.

Due to the strong concerns regarding the degradation of the environment by carbon emissions, the demand for electric vehicles (EV) is skyrocketing around the world. As per the International Energy Agency (IEA), in 2010, there were merely 17,000 electric cars on the roads, and by 2019, their number had swollen massively to 7.2 million! As these vehicles either do not have an internal combustion engine (ICE) or have one, which is supplemented by another power source to cut down on the emissions, the battery becomes really important.

Market Segmentation Analysis

The lithium–ferrophosphate (LFP) category held the largest share in the cathode material for automotive lithium-ion battery market in the past, on the basis of type. The biggest advantage of LFP batteries is their higher energy density, which allows for a longer driving range per charge. Moreover, these batteries also take longer to self-heat than those with other cathode materials, therefore do not deteriorate that quickly.

In the years to come, the highest revenue CAGR, of 7.8%, in the cathode material for automotive lithium-ion battery market is projected to be seen by the passenger car division, based on vehicle type. The government in countries such as China and the U.S. is giving a strong push to the adoption of electric cars. This is impelling battery manufacturers and automakers to come up with fully electric cars that offer higher driving range on a full charge.

Share

The cathode material for automotive lithium-ion battery market will be dominated by the battery electric vehicle (BEV) category throughout the next decade, under the vehicle technology segment. BEVs only have a battery for power, unlike hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs), which also have an internal combustion engine (ICE). Therefore, the batteries used in BEVs must have a higher capacity, for which more cathode material needs to be used.

Trends

Asia-Pacific (APAC) is the largest contributor to the cathode material for automotive lithium-ion battery market presently. The largest EV market in the world, it creates the largest demand for automotive lithium-ion battery components. China is the largest market in the region, as it registers almost 50% of the regional EV sales, including the highest sales of electric trucks and buses in the world.

In the coming years, the fastest advance in the cathode material for automotive lithium-ion battery market is predicted in Latin America, Middle East, and Africa (MEA). From 1.6 Gigawatt-hours (GWh) in 2019, 7.6 GWh worth of automotive lithium-ion batteries, in terms of capacity, are expected to be in use in the region by 2024. This would be a result of the increasing adoption of electric cars in Brazil, Mexico, South Africa, the U.A.E., Colombia, and Israel, which would lead to the rising consumption of cathode material.

Market Players Entering into Collaborations for Continued Growth

In order to continuously grow in the cathode material for automotive lithium-ion battery market, players are entering into partnerships, mergers, and acquisitions, with the idea to:

- Produce methanol at their existing coal-to-olefins (CTO) plants

- Secure customers for their LFP materials

- Broaden their polyamide capabilities

- Develop engineering solutions for e-mobility

- Increase their portfolio of silicon alloy-based anode materials

Cathode Material for Automotive Lithium-Ion Battery Market Outlook

The major companies in the global cathode material for automotive lithium-ion battery market are 3M Co., Panasonic Corporation, BASF SE, POSCO, NEI Corporation, Hitachi Chemical Company Limited, Mitsubishi Chemical Holdings Corporation, Umicore SA, Nichia Corporation, and Johnson Matthey PLC.

Among these, the LFP category held the largest share in the cathode material for automotive lithium-ion battery market in 2019, as this material displays a slower self-heating rate than others. Another major reason automakers prefer batteries with the LFP chemistry is their higher energy density, which allows for a longer driving range on a full charge. With the number of charging stations agonizingly low in most parts of the world considering the number of EVs being bought, having a battery that offers a longer driving range is important.

Apart from the range anxiety, the other major factor discouraging many to purchase EVs is their high price. Presently, the battery, being the most-critical component of EVs, accounts for almost 40% of their total purchase price. Since the cathode itself holds an around 30% share in the price of the battery, research is being done to source cost-effective cathode material. However, in their quest to develop cheaper cathode, material providers are taking care not to degrade its quality, which would have a severe impact on the energy density, in turn, the driving range.

Due to the high demand for EVs, Asia-Pacific (APAC) dominated the cathode material for automotive lithium-ion battery market during the historical period (2014–2019), and the situation is expected to be the same during the forecast period. As per the IEA, almost 47% of the 7.2 million electric cars operational in 2019 were on the roads of China! This is because its government has been relentlessly offering substantial purchase subsidies and tax rebates to encourage the usage of EVs, as is India, under its FAME India scheme.

The research offers market size of the global cathode material for automotive lithium-ion battery market for the period 2014–2030.

Type

- Lithium–Iron Phosphate (LFP)

- Lithium–Manganese Oxide (LMO)

- Lithium Nickel Cobalt Manganese/Lithium Nickel Manganese Cobalt (NMC)

- Lithium–Titanate Oxide (LTO)

- Lithium–Nickel–Cobalt–Aluminum Oxide (NCA)

Vehicle Type

- Two-Wheeler

- Passenger Car

- Commercial Vehicle

Vehicle Technology

- Hybrid Electric Vehicle (HEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Battery Electric Vehicle (BEV)

Regional Analysis

- North America Cathode Material for Automotive Lithium-Ion Battery Market

- By type

- By vehicle type

- By vehicle technology

- By country – U.S. and Canada

- Europe Cathode Material for Automotive Lithium-Ion Battery Market

- By type

- By vehicle type

- By vehicle technology

- By country – Germany, France, U.K., Norway, Sweden, Netherlands, and Rest of Europe

- Asia-Pacific (APAC) Cathode Material for Automotive Lithium-Ion Battery Market

- By type

- By vehicle type

- By vehicle technology

- By country – China, Japan, South Korea, India, and Rest of APAC

- Latin America, Middle East, and Africa (LAMEA) Cathode Material for Automotive Lithium-Ion Battery Market

- By type

- By vehicle type

- By vehicle technology

- By country – Brazil, Mexico, and Rest of LAMEA

This study covers

- Major factors driving the market and their impact during the short, medium, and long terms

- Market restraints and their impact during the short, medium, and long terms

- Recent trends and evolving opportunities for the market participants

- Historical and the present size of the market segments and understand their comparative future potential

- Potential of on-demand logistics services, so the market players make informed decisions on the sales of their offerings

- Competitive scenario of various market segments across key countries in several regions for uncovering market opportunities for the stakeholders

- Major players operating in the market and their service offerings

P&S Intelligence

P&S Intelligence provides market research and consulting services to a vast array of industries across the world. As an enterprising research and consulting company, P&S believes in providing thorough insights on the ever-changing market scenario, to empower companies to make informed decisions and base their business strategies with astuteness. P&S keeps the interest of its clients at heart, which is why the insights we provide are both honest and accurate. Our long list of satisfied clients includes entry-level firms as well as multi-million-dollar businesses and government agencies.

Contact:

P&S Intelligence

International: +1-347-960-6455

Email: enquiry@psmarketresearch.com

Web: https://www.psmarketresearch.com

Above all,most importantly,

certainly,That is to say,

in other words,to clarify,

Therefore,as a result,

so,consequently,

In conclusion,to sum up,

in short

Above all,most importantly,

certainly,That is to say,

in other words,to clarify,

Therefore,as a result,

so,consequently,

In conclusion,to sum up,

in short